Reshape the landscape of the semiconductor industry

In the ever – changing global semiconductor industry landscape, every fluctuation in the market pattern stirs the nerves of numerous enterprises. On April 10th, local time, STMicroelectronics NV (ST for short) made a bombshell announcement of a series of detailed plans to reshape its global manufacturing layout. This is like a huge boulder thrown into a calm lake, setting off huge waves. This plan encompasses everything from prioritizing investment in future – oriented infrastructure, to large – scale deployment of artificial intelligence and automation technologies, to the significant decision of laying off 2,800 employees globally. Behind these series of measures, in fact, is ST’s struggle to break through in the severe market situation. As early as February 1st this year, due to high inventory backlogs, weak market demand leading to a deterioration of its performance in 2024, and an earnings guidance for the first quarter of 2025 that was far lower than market expectations, as a major Microcontroller Unit (MCU) manufacturer, ST had already taken the lead in revealing that it planned to temporarily close several wafer fabs within the current fiscal year and cut approximately 3,000 jobs.

According to the financial reports for the fourth quarter of 2024 and the full year of 2024 released by ST at that time, ST’s revenue in 2024 decreased by 23.2% year – on – year to $13.27 billion. The operating profit margin was 12.6%, a year – on – year decrease of 14.1 percentage points, and the net profit plummeted by 63.0% year – on – year to $1.56 billion. Among them, the revenue in the fourth quarter of 2024 declined by 22.4% year – on – year to $3.32 billion, with a gross profit margin of 37.7%; the operating profit margin was 11.1%; and the net profit plummeted by 68.4% year – on – year to $341 million. Jean Marc Chery, President and CEO of STMicroelectronics, explained that the weak industrial and automotive markets in Europe affected the overall results. “In the industrial sector, in the fourth quarter of 2024, we continued to face a delayed recovery and inventory adjustment, especially in Europe, where our book – to – bill ratio remained below 1,” Jean Marc Chery further explained. “2024 was one of the worst years in decades for the industries we serve, especially in the industrial and automotive businesses, which were characterized by unexpectedly weak end – market demand and rising inventory levels, having a significant impact on STMicroelectronics.”

Due to the decline in demand in the two key markets of industry and automotive, as well as the persistently high inventory levels throughout the year in the supply chain, STMicroelectronics expected its revenue in the first quarter of 2025 to decrease by approximately 27.6% year – on – year (a 24.4% decrease quarter – on – quarter) to $2.51 billion, which was lower than market expectations. Lorenzo Grandi, CFO of STMicroelectronics, also said at that time: “Regarding the distribution inventory this quarter, we haven’t seen significant inventory reduction. I would say that the inventory is still in an excess state. This excess inventory is expected to remain at around one or two months.”

The dismal performance in 2024 and the earnings guidance for the first quarter of 2025 have hindered STMicroelectronics’ ambition to achieve $20 billion in revenue by 2030. Therefore, STMicroelectronics launched a restructuring plan in October 2024, aiming to save $300 million to $360 million in costs annually by 2027 in terms of operating expenses (SG&A and R&D) compared to the cost base in 2024. The latest announced plan of laying off 2,700 employees by STMicroelectronics is part of the plan announced in October 2024. It aims to further enhance STMicroelectronics’ competitiveness, solidify its position as a global semiconductor leader, and ensure the long – term sustainability of its integrated device manufacturer (IEM) model by leveraging its global strategic assets in technology research and development, design, and mass production.

Jean – Marc Chery, President and CEO of STMicroelectronics, said about the newly announced plan: “The manufacturing layout reshaping plan announced today will leverage our strategic assets in Europe to secure the future development of our integrated device manufacturer (IDM) model and enhance our ability to innovate more quickly, benefiting all stakeholders. By focusing on advanced manufacturing infrastructure and mainstream technologies, we will continue to make full use of all existing fabs and redefine the missions for some of them to support their long – term success. We are committed to managing this plan in a responsible manner, adhering to our long – held values, and implementing it entirely through voluntary measures. The technology research and development, design, and mass production activities in Italy and France will continue to be at the core of our global operations and will be strengthened through planned investments in mainstream technologies.”

Improving the Efficiency of the Entire Manufacturing Business through Innovation and Scaling Up

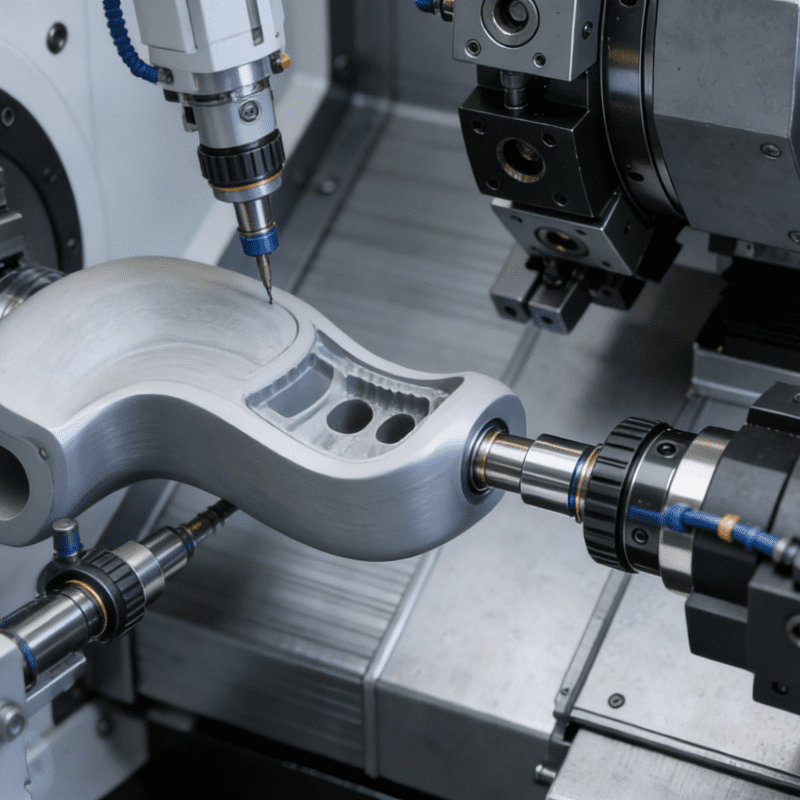

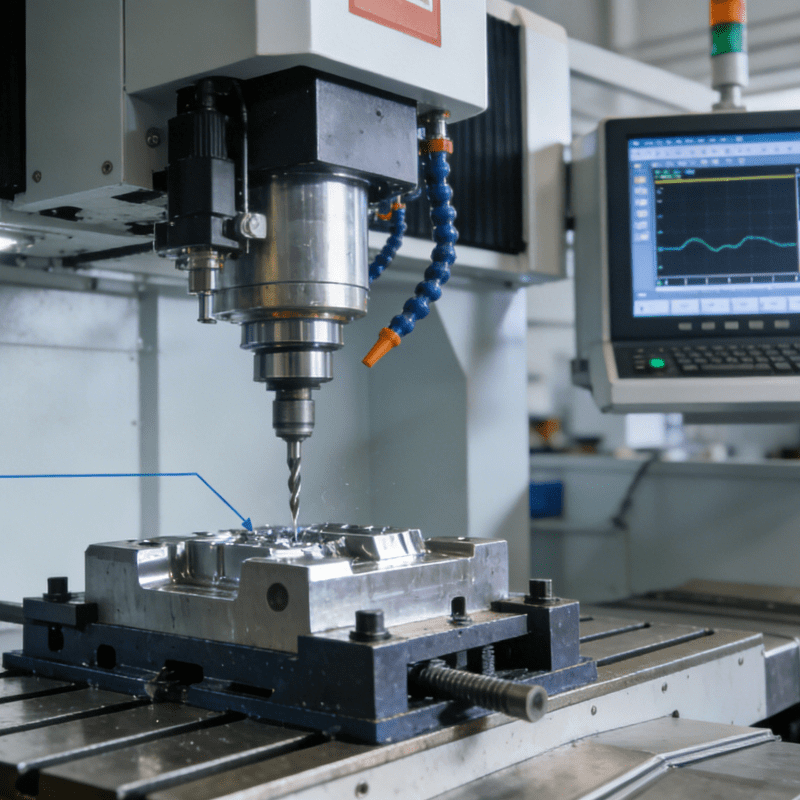

With the shortening of the innovation cycle, ST’s manufacturing strategy is also evolving to accelerate the large – scale delivery of innovative proprietary technologies and products to customers in global automotive, industrial, personal electronics, and communication infrastructure application fields. The reshaping and modernization of STMicroelectronics’ manufacturing business aims to achieve two major goals: prioritize investment in future – oriented infrastructure, such as 300mm silicon wafer fabs and 200mm silicon carbide wafer fabs, to bring them to a critical scale; and maximize the productivity and efficiency of the existing 150mm production capacity and the mature 200mm production capacity. At the same time, STMicroelectronics plans to continue investing in upgrading the technologies used in its operations, deploying more artificial intelligence and automation technologies to improve the efficiency of technology research and development, manufacturing, reliability, and certification processes, and continue to focus on sustainability.

Strengthening STMicroelectronics’ Manufacturing Ecosystem

Over the next three years, STMicroelectronics’ manufacturing layout will be reshaped to strengthen its complementary ecosystem: the French fabs will focus on digital technologies, the Italian fabs on analog and power technologies, and the Singapore fab on mature technologies. The optimization of these operations aims to achieve full utilization of production capacity and drive technological differentiation, thereby enhancing global competitiveness. As previously announced, each of STMicroelectronics’ existing fabs will continue to play a long – term role in the company’s global operations.

Specifically, the 300mm wafer fab in Agrate, Italy, will continue to expand, aiming to become STMicroelectronics’ flagship mass production fab for smart power and mixed – signal technologies. STMicroelectronics plans to double the production capacity to 4,000 wafers per week (wpw) by 2027 and has plans for modular expansion to increase the capacity to 14,000 wafers per week (wpw), depending on market conditions. As we increase our focus on 300mm manufacturing, the 200mm wafer fab in Agrate will refocus on MEMS (Micro – Electro – Mechanical Systems).

The 300mm wafer fab in Crolles, France, will further solidify its position as the core of STMicroelectronics’ digital product ecosystem. STMicroelectronics plans to increase the production capacity of this fab to 14,000 wafers per week by 2027 and, depending on market conditions, expand the capacity to 20,000 wafers per week through modular expansion. In addition, STMicroelectronics will transform the 200mm wafer fab in Crolles to support high – volume production of electronic wafer sorting and advanced packaging technologies, carrying out activities that currently do not exist in Europe. STMicroelectronics will focus on next – generation leading technologies such as optical sensing and silicon photonics.

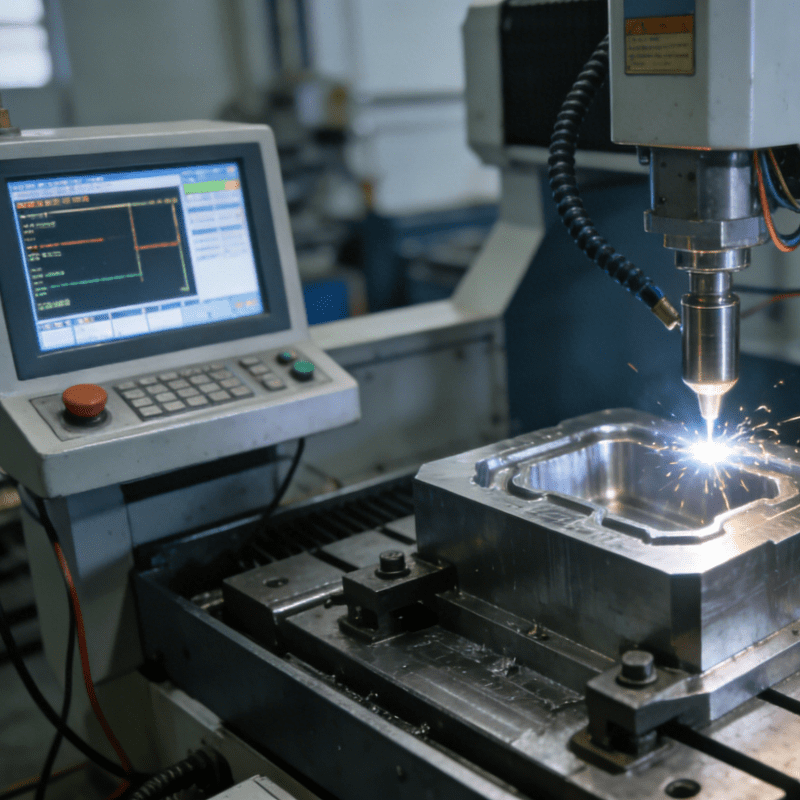

The Catania Power Electronics Specialty Manufacturing and Competence Center will continue to serve as a center of excellence for power and wide – bandgap semiconductor devices. The construction of the new silicon carbide park is proceeding as planned, and production of 200mm wafers is expected to begin in the fourth quarter of 2025, which will consolidate STMicroelectronics’ leading position in next – generation power technologies. The resources we currently use to support the 150mm and EWS production capacities in Catania will be refocused on the production of 200mm silicon carbide and silicon – based power semiconductors, including gallium nitride on silicon, which will strengthen STMicroelectronics’ leading position in next – generation power technologies.

The Rousset (France) wafer fab will continue to focus on 200mm manufacturing and will reallocate additional production from other sites to fully saturate the existing manufacturing capacity, thereby optimizing efficiency.

The Tours (France) fab will continue to focus on some processes of its 200mm silicon wafer production line, and other production activities (including the original 150mm manufacturing business) will be transferred to other fabs of STMicroelectronics. The Tours fab will still serve as the core of GaN (mainly engaged in epitaxy) technology. The Tours fab will also start a new business: panel – level packaging. This is one of the main driving forces behind Chiplet, a technology for complex semiconductor applications that will be crucial for STMicroelectronics’ future.

The Ang Mo Kio (Singapore) wafer fab, STMicroelectronics’ high – volume fab for mature technologies, will continue to focus on 200mm silicon wafer manufacturing and will house our integrated global traditional 150mm silicon wafer production capacity.

STMicroelectronics’ high – volume testing and packaging plant in Kirkop (Malta), located in Europe, will also be upgraded and equipped with advanced automation technologies, which are essential for supporting next – generation products.

The Evolution of the Workforce and Skills

As STMicroelectronics reshapes its manufacturing layout over the next three years, the size of the workforce and the required skills will also evolve. Advanced manufacturing will shift from traditional processes involving repetitive manual tasks to a greater focus on process control, automation, and design. STMicroelectronics will manage this transition through voluntary measures and will continue to be committed to maintaining continuous constructive dialogue and negotiation with employee representatives in accordance with applicable national regulations.

According to current forecasts, in addition to normal staff turnover, this plan is expected to result in up to 2,800 employees voluntarily leaving the company globally. These changes are expected to mainly occur in 2026 and 2027. As the plan progresses, STMicroelectronics will regularly provide updates to stakeholders.

STMicroelectronics’ reshaping plan for its global manufacturing layout this time is undoubtedly a major transformation related to the company’s future destiny. Through the precise positioning and optimal allocation of resources for each production base, increasing investment in advanced manufacturing infrastructure, and actively embracing artificial intelligence and automation technologies, ST hopes to regain the initiative in the fierce global semiconductor competition. Although adjustment measures such as layoffs will bring certain impacts to the enterprise internally and to employees in the short term, in the long run, if it can successfully achieve the transformation goals and enhance production efficiency and product competitiveness, then ST will be expected to open up a new world in the future semiconductor market and continue to write its glorious chapter as an industry leader. In the next three years, as the plan is gradually advanced and implemented, ST will continuously inform stakeholders of the progress. Let’s wait and see how ST breaks through the cocoon and reshapes the industry pattern in this transformation.