Core Performance: Both Revenue and Profit Grow, Realizing a Turnaround from Loss to Profit

On August 22, Haide Control released its semi-annual report for 2025. During the reporting period, the company achieved an operating revenue of 1.28 billion yuan, a year-on-year increase of 15.91%; the net profit attributable to shareholders of the listed company was 11.0609 million yuan, a year-on-year increase of 234.32%; the net profit attributable to shareholders of the listed company after deducting non-recurring gains and losses was -5.9298 million yuan, a year-on-year increase of 78.72%; and the basic earnings per share was 0.0314 yuan.

Business Structure: Three Segments Collaborate to Cover Automation and New Energy Fields

Haide Control’s main business covers three major segments: industrial electrical automation business, industrial information technology business, and new energy business. Specifically, the businesses are as follows: providing comprehensive product solutions and technical services for the automated and intelligent production scenarios of equipment manufacturers; offering system solutions for the digitalization and intelligentization of factories and infrastructure fields; and leveraging power electronics technology, which also falls under the automation field, to provide special equipment and systems for new energy power generation as well as source-grid-load-storage integration.

Industry Environment: Manufacturing Transformation Under Pressure, Green Businesses Embrace Adjustment Opportunities

China’s manufacturing industry is facing the dual challenges of accelerating global layout amid domestic economic structure transformation and global industrial structure reshaping. Benefiting from the continuous guidance of manufacturing revitalization policies, industry demand has gradually stabilized and rebounded. Although the company’s digital business fluctuated between quarters, it remained stable overall. Despite the short-term market conditions of sharp price fluctuations and rapid industry reshuffling faced by the company’s green business, with the implementation of new industry policies, the balance between “marketization” and “benefits” is gradually being achieved, and the industry may gradually enter a healthier and more sustainable development cycle. During the reporting period, the company achieved an operating revenue of 128,021.68 million yuan, a year-on-year increase of 15.91%, and a net profit of 1,106.09 million yuan attributable to shareholders of the listed company, a year-on-year increase of 234.32%, realizing a turnaround from loss to profit.

Market Demand: Manufacturing Investment Growth Slows Down, Significant Differentiation Among Sub-Industries

According to data from BOC International, in the first half of 2025, manufacturing investment increased by 7.5% year-on-year, a decrease of 1.7 percentage points compared with 2024. The growth of manufacturing investment benefits from the demand growth driven by equipment renewal and industrial technology upgrading, but it is also constrained by declining confidence caused by trade frictions, low capacity utilization in some equipment manufacturing industries, and reduced investment demand in traditional raw material industries due to the contraction of the real estate sector. Infrastructure investment growth relies on major projects and new energy infrastructure transformation, while the growth of traditional infrastructure investment is relatively weak. Demand for traditional businesses tends to be saturated, and the new effective demand from emerging service industries is insufficient to support the transition between old and new demands. Additionally, the trend of localization has become more prominent in industries such as rail transit. Except for counter-cyclical industries such as transportation ports, electric power, and automobiles, where revenue increased year-on-year with the recovery of demand, industries that are core to the company’s business revenue, such as rail transit, coal, and metallurgy, all showed declines to varying degrees. During the reporting period, the operating revenue of the company’s industrial information technology business decreased year-on-year, while its operating profit increased year-on-year.

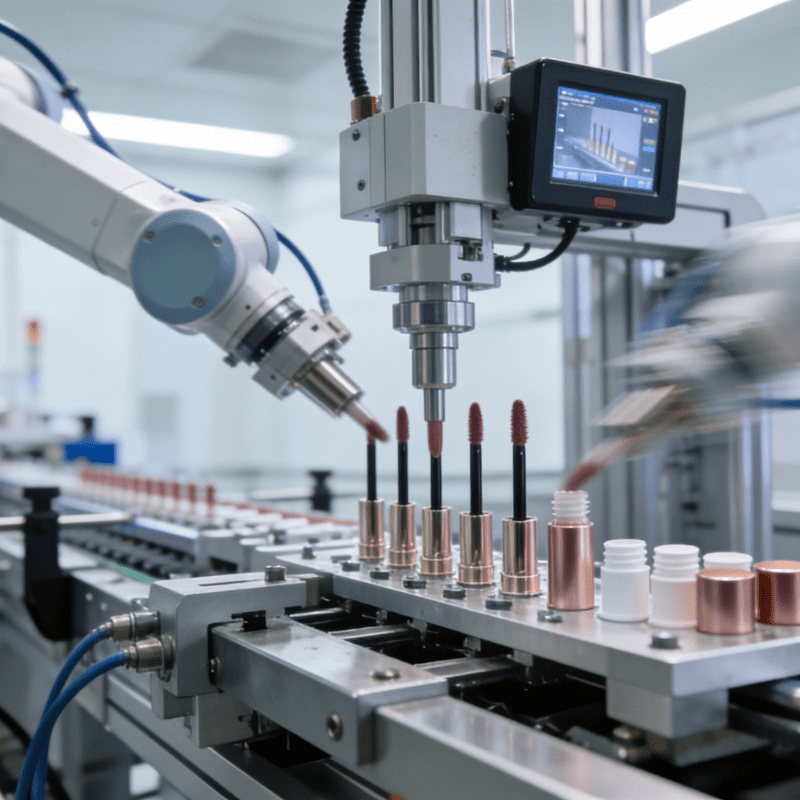

Industrial Automation Business: Market Hits Bottom and Recovers, Customized Solutions Expand Growth Space

In the first half of the year, the cyclical fluctuations in the industrial automation market slowed down, and the market as a whole hit bottom and rebounded, showing significant resilience in recovery. Although it still faces pressure from price competition, under the continuous guidance of manufacturing revitalization policies, since the first quarter, the recovery of capital expenditures in some industries such as automobiles, semiconductors, and lithium batteries has driven the continuous recovery of overall demand in the downstream manufacturing industry. Terminal inventory destocking has improved, and the OEM market has reversed the gap with the project-based market for the first time in three years.

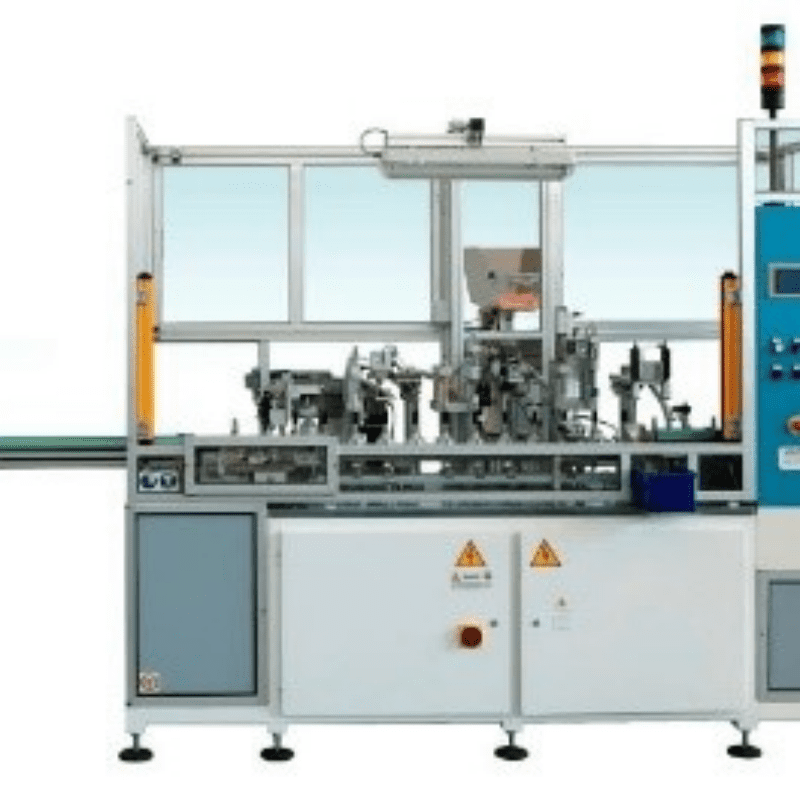

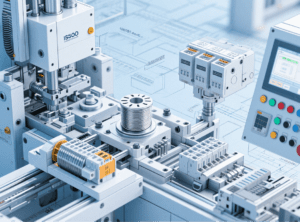

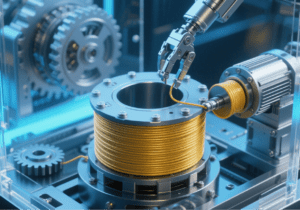

Particularly in the field of power equipment manufacturing, the company’s industrial electrical automation business has launched a targeted automated solution adapted to the Машина за сглобяване на контактори. By integrating a PLC control system, a high-precision servo drive module, and a visual inspection component, it helps the contactor assembly machine achieve full automatic connection of processes such as silver contact pressing, coil winding, and shell packaging. This not only increases the assembly efficiency of a single contactor by 40% but also enables real-time monitoring of key parameters such as contact alignment and coil resistance, controlling the product defect rate below 0.03%. Currently, this solution has served a number of leading low-voltage electrical appliance manufacturers and has become an important sub-scenario driving the revenue growth of the industrial automation business.

At the same time, the company has reduced the per capita comprehensive sales cost through the implementation of refined management measures, and the working capital turnover has been effectively improved. During the reporting period, the operating revenue of the company’s industrial electrical automation business increased slightly year-on-year, and the operating profit increased year-on-year.

New Energy Energy Storage Business: Industry Supply-Demand Clearing, Focusing on High-Quality Projects to Reduce Costs and Improve Efficiency

Per data from the National Energy Administration, China’s new energy storage installed capacity reached 94.91 million kW in H1 2025 (up ~29% from end-2024), with output growing steadily but costs falling significantly (2024 EPC and system bid prices down ~25% and ~44% YoY respectively). Despite rising installed capacity, the industry faces short-term supply-demand clearing due to price declines and structural mismatches.

To address market volatility, Haide Control strengthened risk management for new centralized energy storage orders, reduced investment in this segment, and focused on high-quality clients/projects. It cut costs sharply via R&D, operation and management resource integration (while ensuring delivery capacity), and made initial progress in industrial & commercial energy storage. During the reporting period, the business saw significant YoY growth in both revenue and profit.