Table of Contents

ToggleChina’s Rare Earth Export Controls: Global Automakers Scramble for Solutions in the Age of Intelligent Automation

Докато светът се върти към intelligent automation and industrial automation, редкоземните магнити са се превърнали в невъзпявани герои на съвременното производство - особено в автомобилните сектори, зависими от automation equipment и усъвършенствана роботика. И все пак, неотдавнашните мерки за контрол на износа на тези критични компоненти от страна на Китай предизвикаха шок в глобалните вериги за доставки, принуждавайки автомобилните производители да преосмислят стратегиите си в среда, където всеки двигател, сензор и роботизирана ръка зависят от редкоземни материали.

Сърцето на кризата: Редкоземни елементи в автомобилните иновации

Редкоземните магнити са гръбнакът на intelligent automation в превозните средства. От електродвигателите в електрическите превозни средства до микроактуаторите в адаптивните системи за окачване, тези материали позволяват ефективността и прецизността, които определят съвременните... automation equipmentНапример, един Tesla Model Y използва над 1 кг неодимово-желязо-борови магнити в силовото си предаване – компоненти, които е почти невъзможно да се доставят извън Китай, който контролира 70% от световното производство на редкоземни елементи.

Търговската война между САЩ и Китай превърна тази зависимост в уязвимост. Когато Китай наложи лицензиране за износ на редкоземни магнити през април, автомобилните производители се изправиха пред труден избор: да се адаптират или да рискуват спиране на производството. Както показа заводът на Ford в Чикаго през май, дори едноседмично спиране на производството поради недостиг на магнити подчертава крехкостта на веригите за доставки, изградени върху... industrial automation който разчита на китайски материали.

Отчаяни решения: Преконфигуриране на производството в условията на ограничен пазар

Глобалните автомобилни производители се надпреварват да смекчат смущенията, като много от тях са насочени към... automation equipment премествания като временно решение. Логиката е проста: Ако Китай ограничава износа на магнити, произвеждайте двигатели в Китай. Например, General Motors обмисля доставка на частично сглобени задвижвания за електрически автомобили до китайски фабрики за монтаж на магнити – заобиколно решение, което добавя разходи, но избягва затварянето на производствени линии. Както отбеляза един мениджър по веригата за доставки: „Само един магнит не може да бъде изнесен, но магнит вътре в двигател, произведен в Китай, може.“

Тази промяна отразява по-широко напрежение между intelligent automation и геополитика. Докато роботите и изкуственият интелект оптимизират производството, те също така увеличават зависимостта от специализирани компоненти. Автомобилните производители сега са в капан в парадокс: За да поддържат автоматизирана ефективност, те трябва да отстъпят част от веригата си за доставки на Китай, дори когато търговските напрежения изискват диверсификация.

Дългосрочни рискове и митът за бързите решения

Краткосрочните решения, като преместването на производството на двигатели, носят скрити разходи. Превозването на некомплектовани компоненти през океаните увеличава въглеродния отпечатък и забавянията, което противоречи на целите за устойчивост. industrial automationМеждувременно, алтернативи като двигатели без редкоземни елементи са технологично жизнеспособни, но им липсва ефективността, необходима за масовия пазар на електрически превозни средства. Както Bosch и Mercedes-Benz намекнаха, дори малки компромиси – като например замяната на високоговорители от редкоземни елементи с по-евтини алтернативи – рискуват да подкопаят качеството на продукта и лоялността към марката.

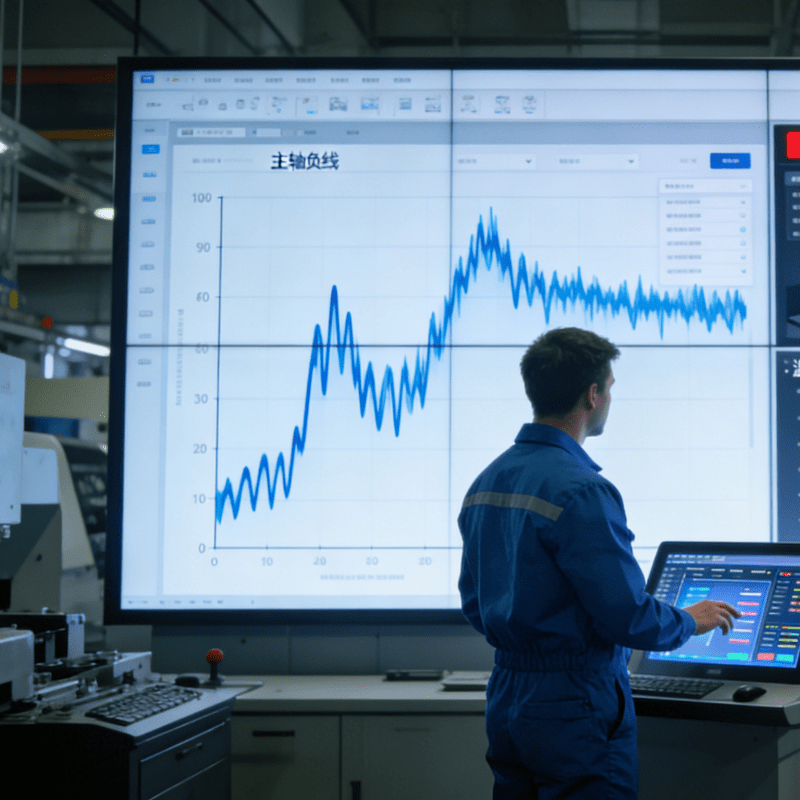

Кризата разкрива и заблудата на „разделянето“ на веригите за доставки за една нощ. Както предупреди Алиансът за автомобилни иновации, възстановяването на екосистемите от редкоземни видове извън Китай може да отнеме години – време, с което автомобилните производители нямат. Междувременно, automation equipment Проектирано за безпроблемно производство „точно навреме“, сега е заложник на политически капризи, като фабрики в САЩ, Япония и Европа се готвят за летни спирания.

Заключение: Кръстопът за автоматизация и геополитика

Контролът на Китай върху редкоземните елементи е нещо повече от търговска тактика; той е зов за събуждане за един свят, зависим от централизирани вериги за доставки. intelligent automationЗа автомобилните производители изборът е ясен: да приемат стратегически компромиси (като частично производство в Китай), за да поддържат поточните линии в движение, или да инвестират в дългосрочна диверсификация, дори с цената на краткосрочна ефективност.

Като industrial automation продължава да трансформира производството, урокът е ясен: Технологичният прогрес не може да изпревари геополитическата реалност. Бъдещето на автомобилните иновации може да зависи не само от роботи и алгоритми, но и от това как нациите и корпорациите се ориентират в деликатния баланс между автоматизация, зависимост и суверенитет.

В крайна сметка, кризата с редкоземните елементи е напомняне, че в ерата на интелигентната автоматизация, дори най-умните машини са толкова силни, колкото и веригите за доставки, които ги поддържат.