As generative AI continues to reshape the boundaries of various industries, humanoid robots are also ushering in their own “highlight moment”.

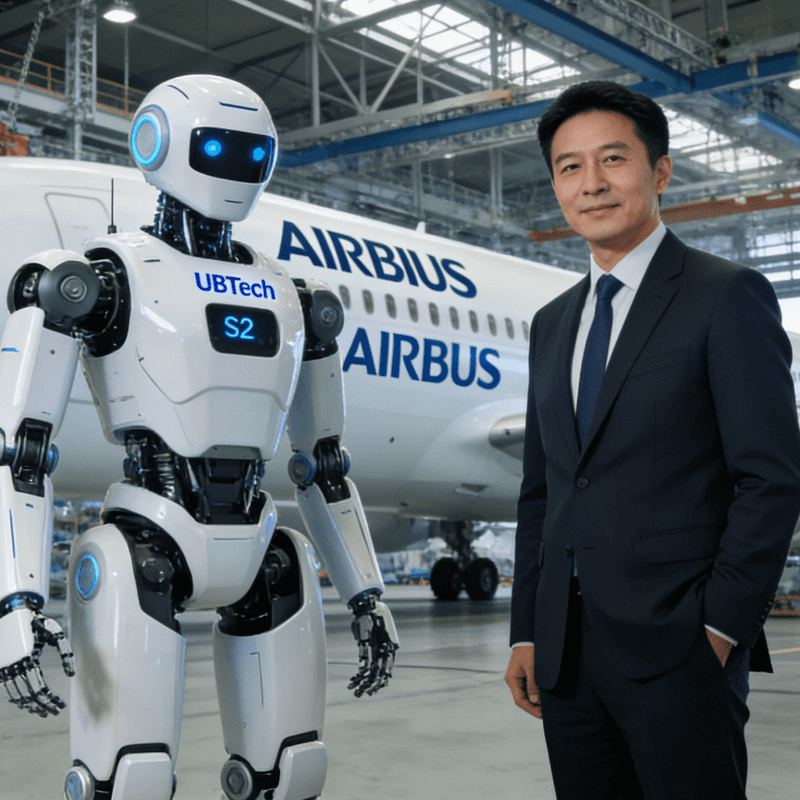

According to the latest statistics from several well-known institutions, global shipments of humanoid robots witnessed significant growth in 2025, among which Chinese brands such as Deep Robotics, Unitree Robotics and UBTECH Robotics have taken a dominant position, accounting for nearly 80% of the market share.

Following the current trend, the industry generally believes that the overall shipment volume of humanoid robots will hit a new high this year.

Nevertheless, as the race for orders and mass production in the humanoid robot track intensifies, voices of calm analysis have begun to emerge. UBS opines that the “electric vehicle moment” for humanoid robots — the turning point for performance leap and market explosion similar to that of electric vehicles — may still be hard to arrive within the next five years.

Mass Production Race: China Has Become the Main Force in Shipments

In the 2025 humanoid robot track, “Chinese strength” has become a label that cannot be ignored.

According to the latest statistical data from market research firm CounterPoint Research, the global installed capacity of humanoid robots reached approximately 16,000 units in 2025, of which over 80% came from the Chinese market. The leading pattern of the industry has initially taken shape — Chinese companies including Deep Robotics, Unitree Robotics, UBTECH Robotics and Turing Robot have firmly occupied four of the top five positions in global installed capacity.

In contrast, overseas players such as Tesla, Figure AI and Boston Dynamics, despite their earlier start, are still in the earlier stage of engineering verification on the whole.

Take Tesla as an example. Although it has repeatedly announced that its Optimus humanoid robot will start mass production in 2026, its robots still rely heavily on manual manufacturing so far. Most public demonstrations are remotely controlled by engineers, and their autonomous capabilities and maturity have not been widely recognized. Even within Tesla, some employees hold reservations about whether Optimus can deliver value in practical scenarios such as manufacturing.

The strong leadership of Chinese enterprises in the humanoid robot track is not accidental, but the result of the multiple resonance of industrial chain, engineering capabilities and scenario demands.

Looking at the market, leading domestic manufacturers have generally crossed the “prototype demonstration” stage and entered the large-scale implementation period featuring “product matrix + scenario focus”. Taking Deep Robotics as an instance, it has launched three product series, namely Lingxi, Yuanzheng and Jingling, covering eight major scenarios such as explanation and reception, industrial manufacturing and logistics sorting. Among the first 5,000 products rolled off the production line by Deep Robotics, 1,846 units belong to the Lingxi X1/X2 series, 1,742 units to the Yuanzheng A1/A2 series, and 1,412 units to the Jingling G1/G2 series.

According to Omdia’s estimation, the shipment volumes of Unitree Robotics, UBTECH Robotics and Turing Robot in 2025 will be about 4,200 units, 1,000 units and 500 units respectively. Among them, Unitree’s humanoid robots are mainly used in research, education and consumer fields. UBTECH Robotics is focusing on its Walker S series to realize application in industrial scenarios such as automobile manufacturing, intelligent logistics and data centers, and has so far secured nearly 1.4 billion yuan worth of orders.

The ability of leading enterprises to rapidly promote scenario implementation is not only due to their outstanding technical strength and business insight, but also inseparable from the initially formed humanoid robot supply chain ecosystem in China.

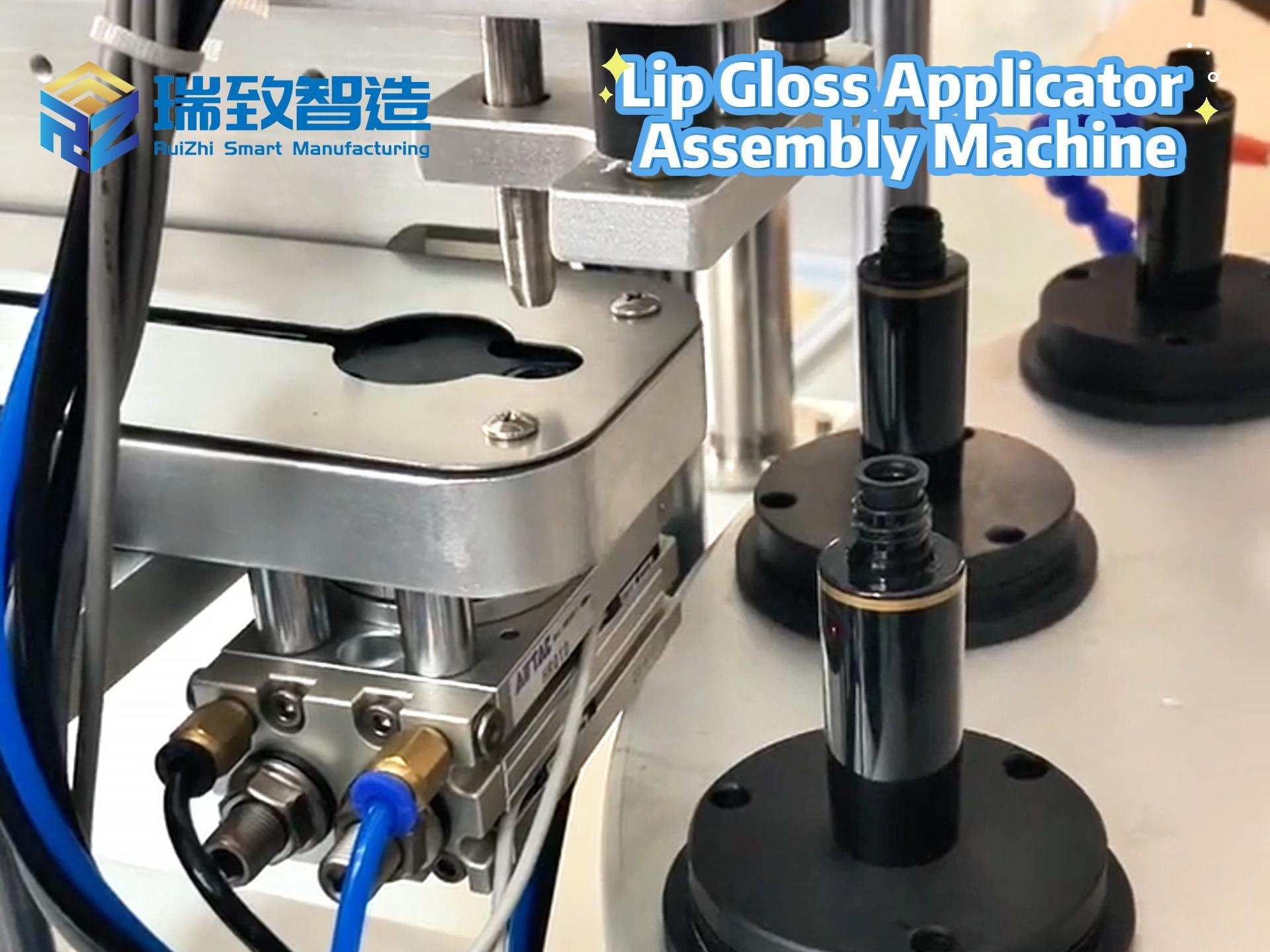

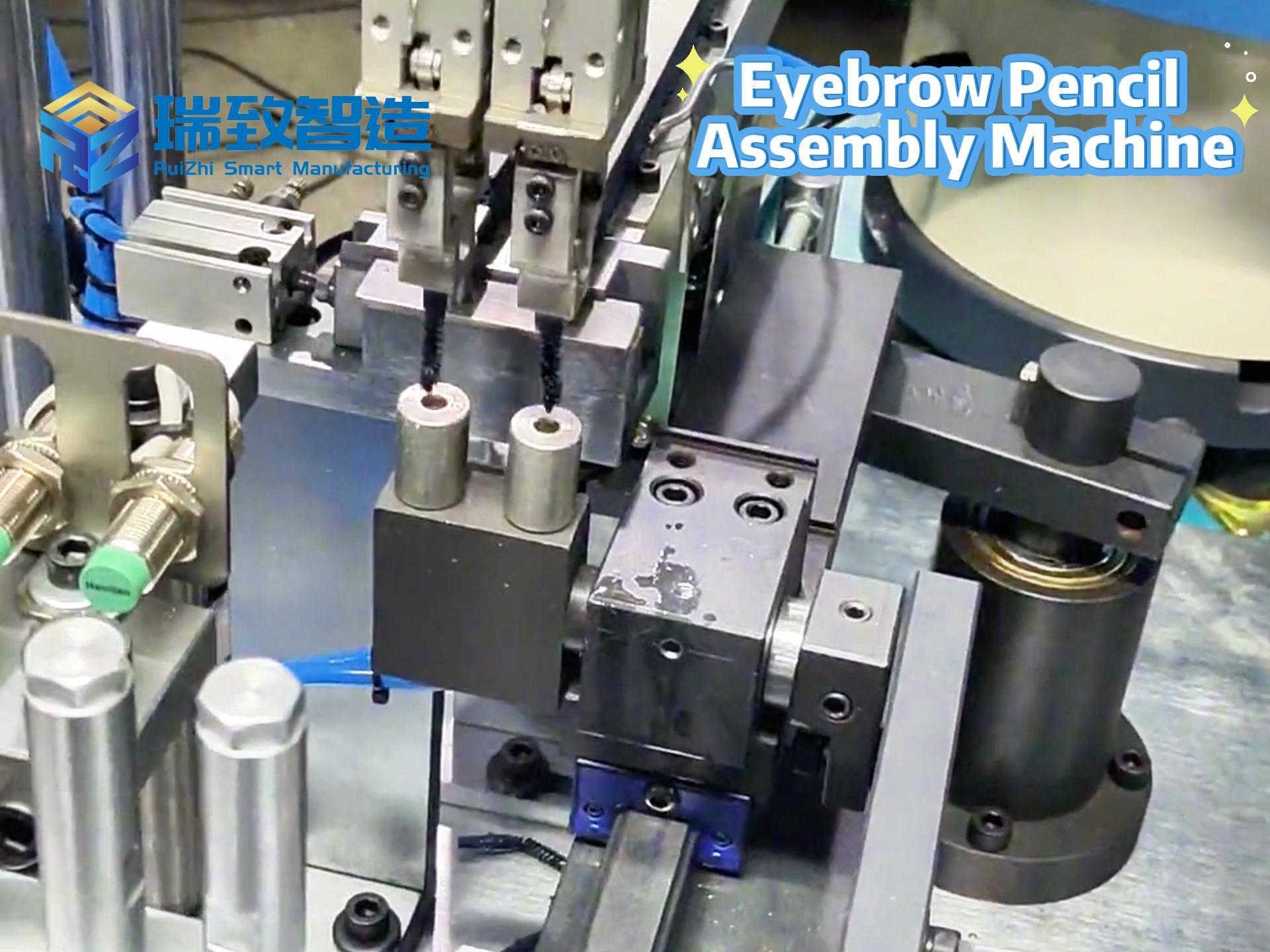

In the field of core components such as sensors, reducers, motors and controllers, a mature and cost-controllable industrial chain has initially taken shape in China, providing key support for humanoid robots to move from laboratory prototypes to stable mass production. Meanwhile, the “rapid trial-and-error, agile iteration” model that Chinese enterprises are good at is exactly in line with the current compound demands of the humanoid robot industry for reliability, cost and implementation speed.

Take harmonic reducers as an example. In the first half of 2025, the relevant business revenue of Grease Harmonic Drive Systems, the leading enterprise in this field, increased by more than 34% year-on-year, and it was successfully selected into the list of the top 100 listed companies in the global humanoid robot field. In the fields of servo systems and controllers, domestic enterprises represented by Inovance Technology have also taken a dominant position.

Above this set of hardware and manufacturing system, there is a deeper driving force: the rapid iteration of AI models.

“Why have humanoid robots accelerated in the past two years? Behind this, besides the improvement in hardware that we can see, a core point is that AI models made very rapid progress two or three years ago, empowering the fast development of humanoid robots in the past two years,” said Wang Feili, China Industrial Analyst at UBS Securities, in an interview with Gasgoo recently.

Still a Long Way to Go Before the “Electric Vehicle Moment”

As the humanoid robot industry continues to thrive, a focal question has emerged: Are humanoid robots about to usher in an industrial explosion inflection point like electric vehicles did a few years ago — the so-called “electric vehicle moment”?

In this regard, UBS Securities once again stated bluntly in its latest analysis that the “electric vehicle moment” for humanoid robots is still unlikely to occur within five years.

The core logic is that the current acceleration of the humanoid robot industry is driven more by supply chain and engineering capabilities, while the fundamental technical bottleneck that determines whether humanoid robots can leap from “specialized tools” to “general-purpose labor” has not yet been broken through.

“We believe that the most important market for humanoid robots in the future is still on the household side. This requires humanoid robots to have strong generalization and versatility, be able to complete a variety of different tasks and adapt to many different household environments. Therefore, the requirements for the ‘brain’ are quite stringent. If the bottleneck of the ‘brain’ is not completely resolved, we believe the ‘electric vehicle moment’ is unlikely to fully materialize,” said Wang Feili.

This judgment directly points to the core contradiction behind the prosperity of the industry: the growth in orders has not been converted into breakthroughs in general capabilities; the expansion of production capacity has not simultaneously solved the fundamental technical bottlenecks.

Specifically, Wang Feili believes that the current “brain” of humanoid robots is mainly facing two major challenges. First, the training data is extremely scarce. Humanoid robots need to interact, trial-and-error and learn in the physical world, but such high-quality, large-scale and multi-modal exclusive datasets are almost blank at present.

Second, there is a lack of AI models truly suitable for robots. The currently commonly used vision-language-action (VLA) models in the industry are not designed for the complex sequential control and physical interaction of robots. A truly suitable “robot-native” large model is still a key breakthrough expected by the industry.

“As long as there are more breakthroughs in ‘brain’ technology, including the accumulation of more data and the emergence of more suitable AI models, we believe the development of humanoid robots may be faster than we expected,” pointed out Wang Feili.

In the longer term, Wang Feili believes that technology is also the key to the real explosive growth of humanoid robots. In her view, when technology has not reached the critical point, although downstream customers have demands, product deficiencies will lead to weak order and purchase intentions, and the scale cannot be expanded.

In fact, besides technical challenges, there are essential differences between humanoid robots and electric vehicles in the logic of transformation.

The electric vehicle revolution is essentially a paradigm shift in the power system, that is, the transformation from internal combustion engines to motor drives. However, the operating infrastructure and usage paradigm are already mature. The core of industrial breakthrough lies in the cost reduction and performance improvement of the three-electric system, as well as the improvement of supporting charging facilities.

In contrast, the humanoid robot revolution is the in-depth reconstruction of the full-stack capabilities of “perception-cognition-decision-execution”. It requires machines to understand intentions, decompose tasks, operate flexibly and ensure safety in dynamic, open and human-designed environments like humans. This is not only a hardware engineering problem, but also an embodiment problem of artificial intelligence in the physical world, whose complexity and uncertainty are far higher than those of electric vehicles.

In view of this, the current “order boom” in the humanoid robot industry should be viewed rationally: at present, the industry is more about the initial verification of “solutions” for clear pain point scenarios within limited capability boundaries, rather than the real maturity of general intelligence.

Accelerated Differentiation: Who Can Survive the Cycle and Who Will Fade Out?

Although humanoid robots are still some time away from the explosive “singularity”, the next evolution path of the industry has become clear.

The industry generally believes that humanoid robots will develop along a step-by-step path of “industry first, then household” and “differentiation first, then integration” in the future, and profoundly reshape the value distribution pattern of the industrial chain in this process.

At present, the pragmatic trend in the humanoid robot track has gradually replaced the early concept frenzy.

On the one hand, in terms of price, compared with the early R&D costs and prototype prices that often reached hundreds of thousands or even millions of yuan, humanoid robots have shown a clear downward price trend. In the past period, many leading enterprises have successively launched entry-level products priced at around 10,000 yuan or even below 10,000 yuan. Although these products are not real “general-purpose household robots”, they have played a pioneering role in market enlightenment and ecological cultivation in primary markets such as education, entertainment and basic services, laying the groundwork for the explosion of higher-level demands in the future.

On the other hand, the rise of the “Robot-as-a-Service (RaaS)” model has also provided new ideas for the industry to break through cost barriers, enabling numerous users to verify the commercial value of robots in many downstream application links with lower initial investment.

For example, the “Qingtian Rental” platform initiated by enterprises such as Deep Robotics and Feikuo Technology has gained over 200,000 users within three weeks of its launch, with an average of more than 200 rental orders per day. This fully demonstrates the strong market demand for flexible and lightweight humanoid robot service models. This model not only has built a small-scale commercial closed loop, but also provided valuable real-scenario data for the continuous iteration of technology.

With the industry’s shift towards pragmatism, the market scale of humanoid robots is expected to grow in a step-by-step manner in the next step.

UBS predicts that on the basis of the shipment volume of over 10,000 units in 2025, the shipment volume of humanoid robots is expected to reach about 30,000 units in 2026. After that, this scale will continue to grow, increasing to about 150,000 units by 2030 and further exceeding 1 million units by 2035.

In the longer term, considering complete machines, components, software, ecological services and other aspects, the potential market scale of humanoid robots is expected to reach 1.4–1.7 trillion US dollars by 2050.

However, the broad market prospect does not mean that all participants in the track can share the dividends equally. UBS believes that the investment value and risks of the humanoid robot industrial chain will show significant differentiation in the next step.

Among them, midstream complete machine manufacturers will take the lead in entering a brutal stage of “stress testing” and elimination.

At present, multiple different layout strategies have emerged in the complete machine camp: one focuses on the robot’s “cerebellum” and provides high-performance bodies for secondary development by downstream integrators; another adopts a customized joint development route by deeply binding with target customers in industries such as automobile and logistics; there is also one that chooses to start from relatively simple scenarios such as guided tours, reception and entertainment.

Despite the different paths, they all share a common point: they are in a critical period of “burning cash” in exchange for technical verification and commercial orders, and enterprises in the track generally face great financial pressure.

In view of this, Wang Feili suggests that more attention should be paid to the actual implementation of relevant enterprises in the next step, including the actual operation efficiency and failure rate of delivered products, the real economic value brought to customers, and crucially — whether the first batch of customers will repurchase after 3–6 months of trial use.

Ultimately, she believes that this competition will also experience a brutal reshuffle from “a hundred flowers blooming” to “a few winners”, just like the electric vehicle industry. “At present, it is still difficult to judge who will win this battle within three to five years. This stage is very similar to the early stage of EVs, with a large number of brands, but the number of EV brands has decreased significantly now. We believe the midstream complete machine manufacturers will follow a similar trend,” said Wang Feili.

In contrast, upstream suppliers of core components and key materials are expected to usher in higher industry prosperity in the next 2–3 years. After all, regardless of changes in the downstream complete machine pattern, the expansion of industrial scale will inevitably translate into massive demand for hardware such as precision reducers, high-performance servo motors, torque sensors, dedicated chips and batteries. Therefore, manufacturers in this link are expected to benefit first from the industry growth and play the role of “water sellers”.

It is worth noting that differentiation will also spread to the capital market.

Wang Feili pointed out in an interview with Gasgoo that some differentiation may also occur in the financing sector this year. “After two or three years of development, gaps will emerge between enterprises. Enterprises with good downstream implementation, customer feedback and mass production orders will attract more investors, but those with mediocre performance and lack of differentiation, especially those focusing on downstream applications or low-threshold components with low entry barriers, will face great pressure and intensified competition.”

This means that for small and medium-sized players who only rely on concept speculation and lack actual technical precipitation and market competitiveness, their living space will be compressed in the future, and they may even face the risk of being eliminated by the market.

But on the other hand, this differentiation at the capital level will in turn further intensify the Matthew effect within the industry, promote the concentration of high-quality resources to leading enterprises, and accelerate the reshuffle and integration of the entire industry.

Conclusion

The next phase of the humanoid robot industry is a comprehensive endurance race integrating technological breakthroughs, business model verification, capital screening and supply chain collaboration.

For China’s robot industry, although it has won a valuable first-mover advantage by virtue of its significant advantages in supply chain and engineering, the real long-term victory depends not only on the strength of the “body”, but also on whether it can inject a smarter “brain” into this body, and complete the in-depth transformation from “Made in China” to “Intelligent Made in China” through continuous feedback from implementation.